D***s

Reviewer

5/5

Good.

5 months ago

J***i

Reviewer

3/5

음질이 너무 안좋네요.. 실망실망..

8 months ago

g***t

Reviewer

5/5

Okkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkk

10 months ago

l***z

Reviewer

5/5

great seller and fast shipping⭐⭐⭐⭐⭐

10 months ago

D***v

Reviewer

5/5

fast delivery, awesome

1 year ago

E***o

Reviewer

5/5

Recommend, good quality, as advertised!

1 year ago

V***l

Reviewer

5/5

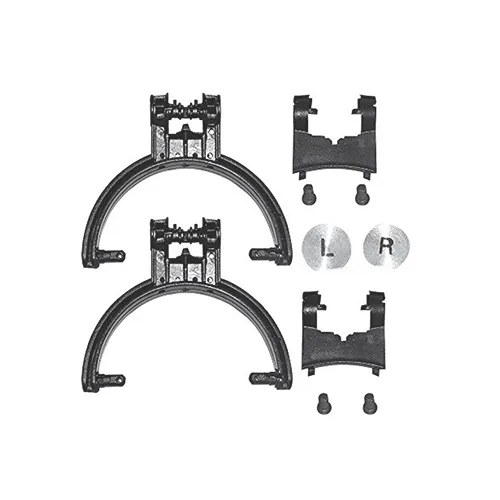

Works well with Sennheiser HD 569, seems well made. Would recommend

1 year ago

B***d

Reviewer

5/5

Great product. Fulfilled expectations.

2 years ago